Insurance-as-a-Service or Insurance-in-a-Box?

Depends where you are. If you’re in the US, you would most likely hear ‘Insurance-as-a-Service’, and if you’re standing in Europe, ‘Insurance-in-a-Box’ is more common. Some people call the beautiful game ‘soccer’ and others call it ‘football’. 😉

So what does Insurance-in-a-Box or Insurance-as-a-Service mean?

Typically insurers are providing their distribution partners (lead gen, brokers, agents, MGA’s etc…) with manual means by which to do the policy administration:

- Quote & bind

- Amendments / Endorsements

- Cancellations & Renewals

- Payments

- Claims FNOL

By manual, we mean usually via the required PDF’s / Excel forms sent through email, and if the partner is lucky, a broker portal and/or integration into their agency management system. You can imagine how big the document management and administration nightmare can be on more complex types of policies.

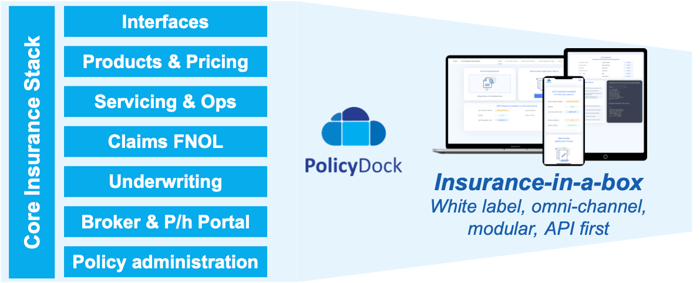

With end-users more and more wanting a self-service digital experience, what PolicyDock can provide distribution partners, brokers and MGAs is basically the entire digital platform (both front-end & back-end) that comes in a box that is already integrated with the insurer, hence Insurance-in-a-Box. The distribution partner, broker or MGA can then digitally provide the insurance product to their end-clients, channel partners or other digital ecosystems via our well-documented APIs as a service, hence Insurance-as-a-Service. See how only PolicyDock has merged these two terms into one. 😎

Paving the way for powerful use cases

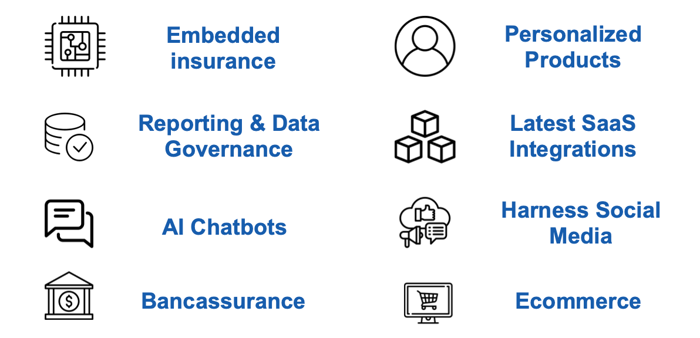

We believe once more partners have our insurance-in-a-box, with our open APIs, each partner will find their own creative ways in which to sell, help clients administer policies, and distribute the product through different digital ecosystems — exponentially scaling innovation in this industry.

What does this mean for carriers who are providing products digitally?

- At least over 80% increase in efficiency due to digital integrations, no manual reporting and less headcount needed — the end client can now do self-service

- Real-time data across the value chain allowing carriers to adapt to market conditions faster

- Higher NPS (Net-Promoter Scores) as clients finally have a seamless digital experience when handling their insurance

So, are you ready to exponentially scale your innovation while driving your bottom line? Contact us here.

Related content: