Who is PolicyDock for — really?

For the past couple of months and even before starting PolicyDock, we’ve made it a point to speak to as many people in insurance as we can: insurance carriers, underwriting management agents, managing general agents, wholesale brokers, retail brokers, digital brokers, insurtech companies , insurance consultants, systems integrators, accounting firms, and the list goes on. From there, we really extrapolated what are the common nuances and problems each entity in the value chain faces.

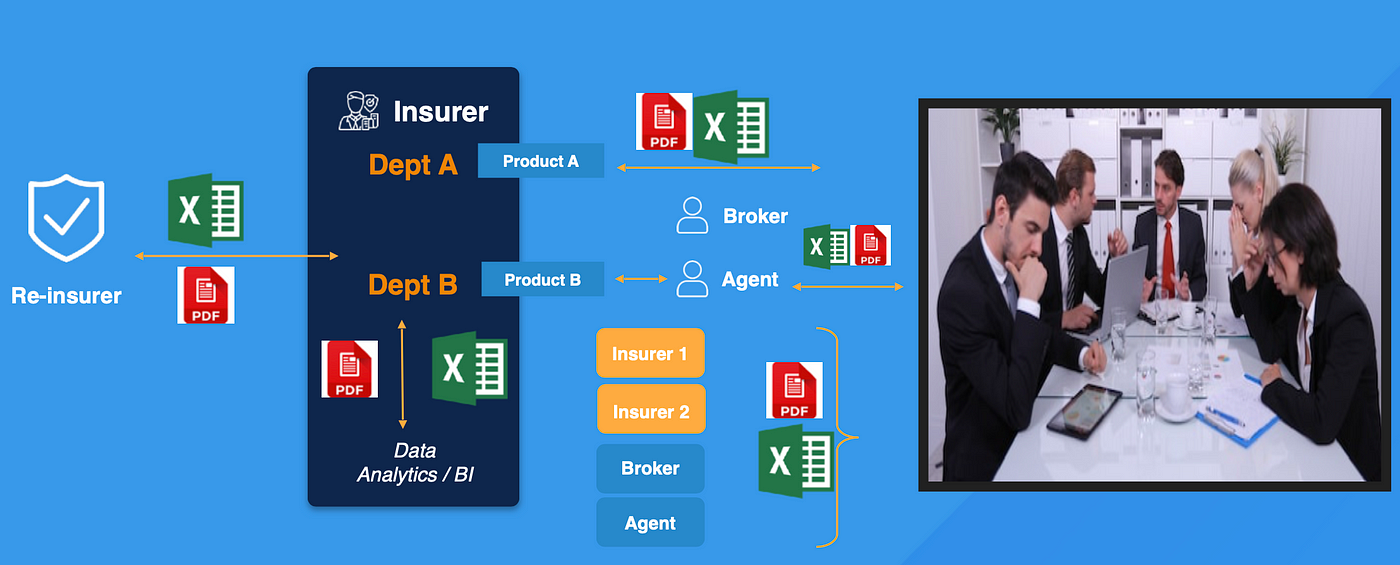

In general, we pretty much thought the landscape looks like this:

Lengthy sales meetings with brokers who are gathering information manually and relaying that information via email and PDF’s/XLS.

The problem:

Wherever you go in the value chain (broker, agent, insurtech, insurer, re-insurer, BI department etc…), there’s a PDF, CSV (comma separated value) or Excel file being interchanged via a lengthy email chain, which can be excruciatingly painful to reconcile, import, export, format from or into current systems. For example, a re-insurer typically wants to see a Bordereaux report from the insurer on a monthly basis, which is basically a granular breakdown of insurance premiums, taxes, claims and broker fees for each product. Imagine the offline work that goes in with legacy systems into preparing that report each month.

Essentially, what we derived from all our communications is that insurance breaks and becomes inefficient due to ineffective communication — in a perfect world, if we all spoke the same language, wouldn’t it be so much easier to get our points across? Then it basically dawned on us, insurance products globally do not differ much — there are only so many re-insurers in the world, it’s a top down pyramid.

Innovative insurance technologies are needed

At PolicyDock, we decided that to fix insurance, we need to fix the protocols. Global languages that people understand: body language, mathematics, finance. The language of the web to make devices interoperate: API’s (Application Programmable Interfaces). The above picture should look more like this:

A real time data environment where data is automatically structured and formatted to be interoperable between software systems.

What is an API ?

Whoa! This post is getting complicated, API’s, modules, machines, web languages, is it AI? Are machines taking over the world? What’s going on here? Relax… All an API is, is that when you click a button on a webpage, a signal is sent to a server telling the software program which button is clicked and subsequently the software program will send a digital signal back to your web browser to tell it what to do. Those digital signals contain data via an API. It’s like emailing an Excel sheet to your colleague and then telling your colleague what all the rows and columns of numbers mean, via an API, the software program knows automatically and then knows what to do next.

To illustrate the difference:

Imagine how swift an organization can be when built on API’s that automate needless workflows

Once a specific insurance product can be controlled via these API’s, a lot can happen (think www.lemonade.com).

We will be visiting a lot of these use cases in future posts, but here’s a non-comprehensive list of what PolicyDock can be used for and I’m sure there’s still more we haven’t thought about (get in touch if you have an idea, we’ll find some way to reward you 😉)

For Insurance Product Carriers (re-insurers, insurers, MGA’s, UMA’s) can use PolicyDock to:

- Integrate with new digital distribution channels: APPs, marketplaces, websites, insurtechs, social media etc…

- Embed insurance at the point-of-need, e.g. flight delay insurance when you buy an air ticket

- Bancassurance: selling insurance as part of banking products

- Automate their underwriting connecting to 3rd party rate tables or hosting it via us

- Building their own mobile APPs, web portals or other UX experiences on top of these API’s (it becomes 10x easier and faster once you have them)

- Launch new products fast to tap into different niche markets

- Offer online portal for brokers — can give access for digital savvy brokers to build on top of these API’s (more in a later post)

- Customize documents for different sales channels if necessary

- Have data structured so Business Intelligence departments can spend more time analyzing data in real-time (as opposed to cleaning data)

- Re-insurers can get all the necessary data in real-time and automatically

- Sending claims notice-of-first-loss immediately to claims administrators

- Automate policy renewals, endorsements and/or cancellations

- Integrate with latest technologies and insurtechs that are out there (programmers LOVE well-documented API’s) e.g. chatbots

- Super easy to switch out different technology integrations

- Automatically prepare required department reports / Business Intelligence

- Use all the latest SaaS services that are out there (Hubspot, Tableau, Zapier, etc…)

- Sandbox development testing for internal tech departments of new types of digital products

- Multiple payment channel integrations

- Integrate with old core legacy systems (YES, it’s still compatible)

- Offer this as a service to brokers to help them with administration and automate their workflows

For insurance brokers and product distributors:

- Integrate with insurers who already have API’s and structure the data for their own internal usage

- Help insurers automate their products and provide a common, collaborative tool (with permissions and access restrictions, of course) to administer policies and product

- As a wholesale broker, provide both online portal and API’s to your retail brokers

- Many of the same digital distribution & digital tool integrations use-cases mentioned above also apply to brokers and distributors

- Provide a client portal for your clients to login, check their policies and perform actions if necessary

For Insurtechs / Tech Companies:

- Instantly provide a demo of how your solution would work for an insurer, with easy integration (into their legacy systems)

- Need a policy administration system that you can fully control and customize

- Have an instant back office to integrate with an insurer or multiple insurers

- A common platform to integrate your tech solution with an insurer (allows for easy tracking of policies for both parties) — super effective when trying to sell to an insurer

- Avoid trying to integrate with core legacy systems (it’s painful, trust us)

And I’m sure there’s a whole host more use-cases!

Get in touch with us: info@policydock.com